LITTLE ROCK, Ark. — The U.S. Federal Reserve announced on Wednesday that they will increase the interest rate by 0.75%.

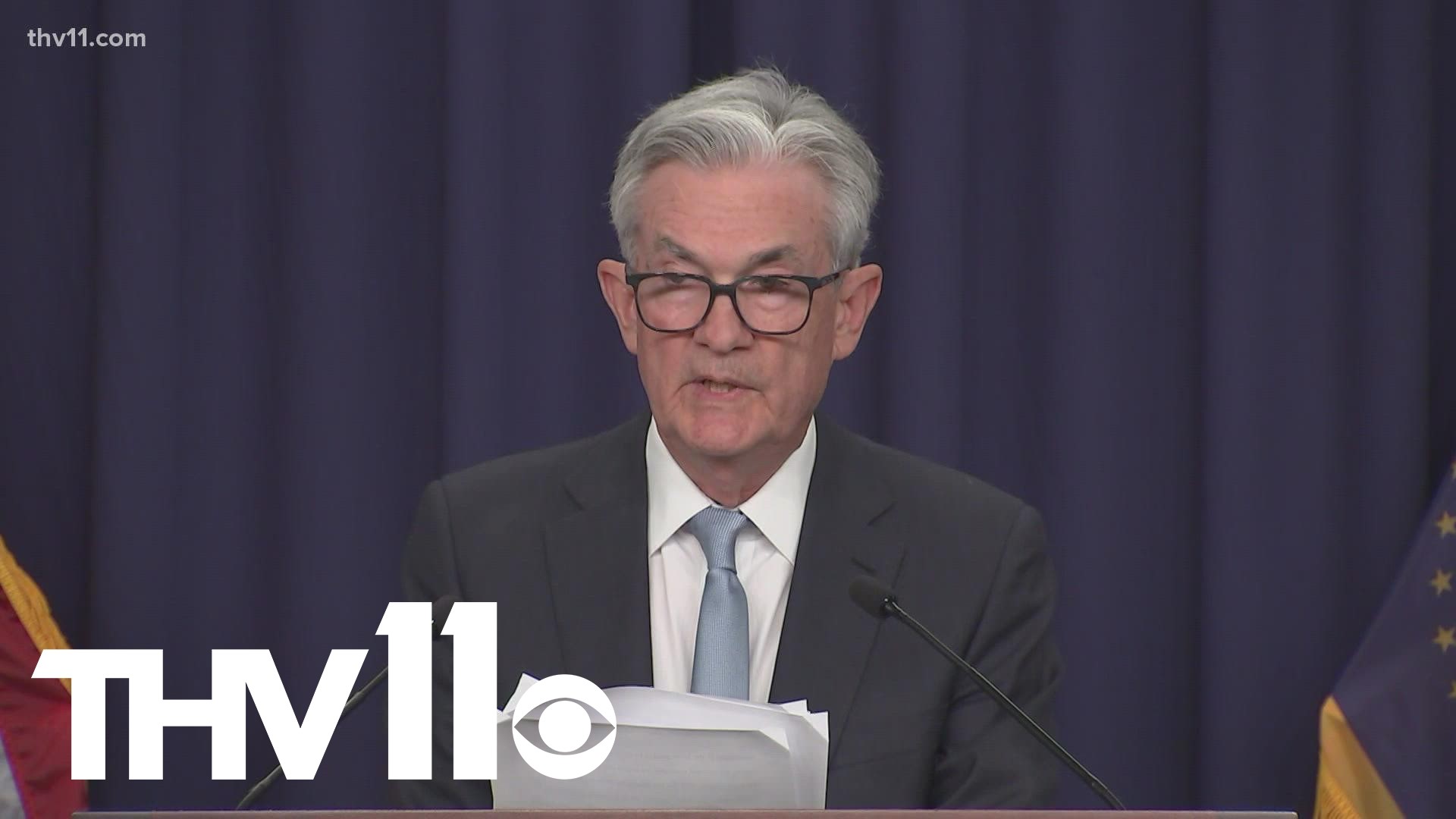

"High inflation poses significant hardship, especially on those least able to meet the higher costs of essentials like food, housing and transportation," said Jerome Powell, Federal Reserve Chairman.

The Feds typically aim for an inflation rate of around 2%, but we've seen a much higher rate in these last several months.

"The Federal Reserve raising interest rates is their primary tool to try to bring the rate of inflation down," said Jeremy Horpedahl, professor of economics at UCA.

How could this interest rate hike affect you?

People who have a mortgage or a loan on a car will now have to pay more.

"These rates are going up as the Federal Reserve raises the interest rates to banks charge each other," Horpedahl said.

He also said the Feds will likely continue to raise those rates.

Horpedahl's recommendation for anyone looking to borrow money is that they do it sooner, rather than later.

"There is increasing urgency that if you need to make those types of loans, or borrow that money, now is gonna be a good time to do it," Horpedahl said.

He also said it could have an impact on spending around the country. The latest interest rate hike could also affect those that have been gearing up for retirement.

"They are trying to figure out, you know, what do things cost and how much money am I going to be able to pull out once I retire," Horpedahl said.

"Consumer spending, as well as businesses borrowing money to invest, are two things which could be slowed down by rising interest rates," he said.

As the U.S. Federal Reserve has tried to slow down the price of goods, Horpedahl adds that people should work on ways to save money.

"Think about how large of an emergency fund you need. Maybe that needs to be a little bigger now, because the chance of a recession is going up," Horpedahl said.

The Fed wants to pull off a complicated trick and raise interest rates just enough to cool off the economy, but if they raise rates too much, that could trigger a recession.