LITTLE ROCK, Ark. — Typically, there are very few people who enjoy doing their taxes, and there's even fewer who enjoy doing other people's taxes.

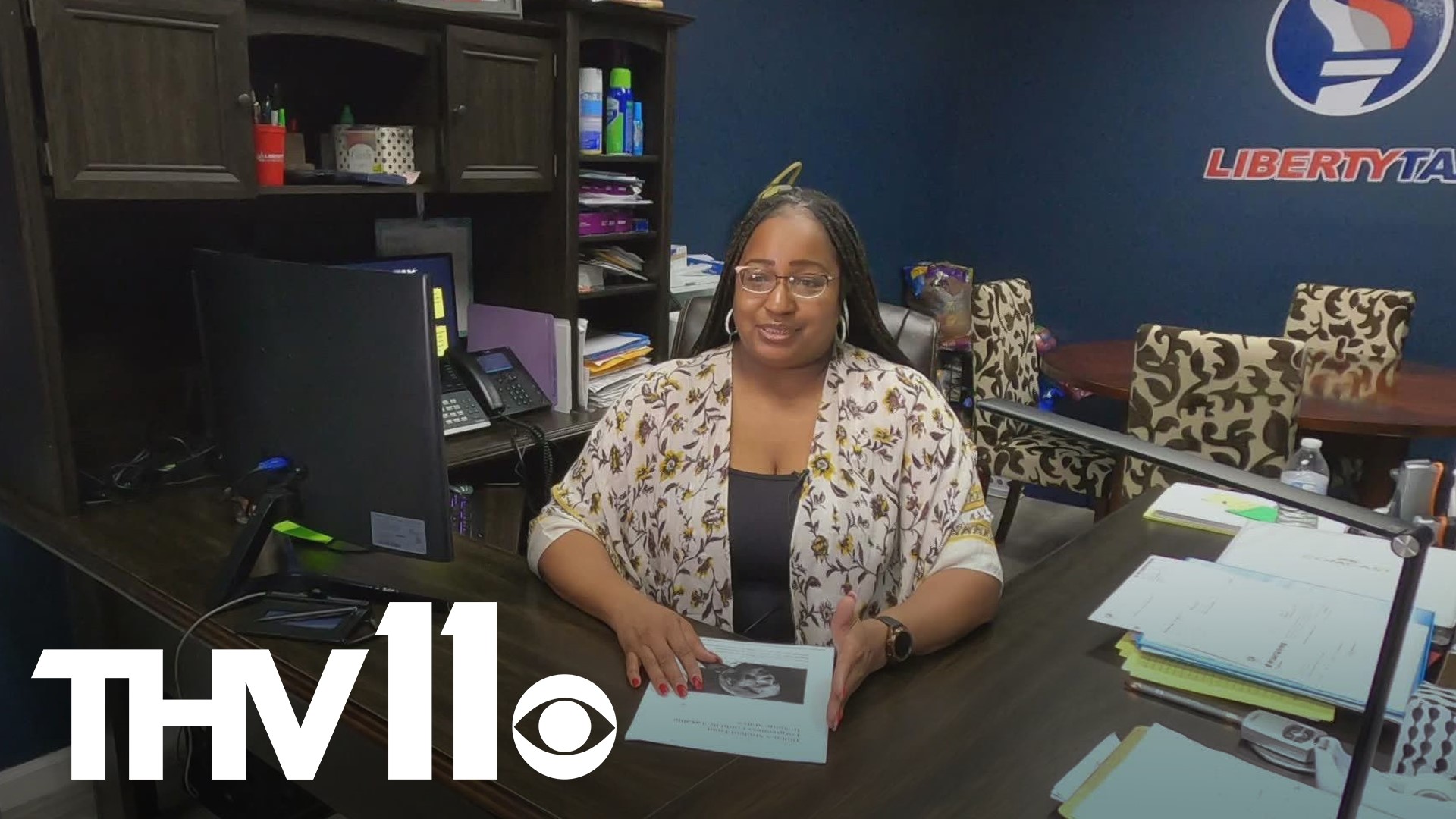

Latasha McKinney, District Manager at Liberty Tax in Little Rock, is the rare exception.

"I've been doing taxes for about 30 years. There's nothing we can't handle," McKinney explained.

Since the Biden Administration's announcement last week on student loan debt relief, there are new challenges ahead for her. Like many others, McKinney said she couldn't believe it.

"I was excited," she said, "For me and my daughter."

There has also been something else on her mind— and that's how it will affect her work and everyone out there who has been left with questions.

One of the biggest questions on everyone's mind – could that relief be taxed?

"The very last report I received, Arkansas was on the list where it could very well be taxed on the state level," McKinney stated.

According to the Tax Foundation, a nonprofit based in Washington, D.C., Arkansas is among 12 other states that have been considering taxing loan relief.

That foundation lists Arkansas as possibly having a maximum tax of $550, although McKinney said that number is hard to predict.

She also mentioned that it's also hard to predict when this will happen. The Biden Administration announced the plan for relief, but there haven't been any updates as far as how it will be implemented.

"So even though that was released just last week, don't expect anything this week to just say you have a zero balance," she explained.

McKinney said her best guess is the end of the year because tax updates usually happen between October and December.