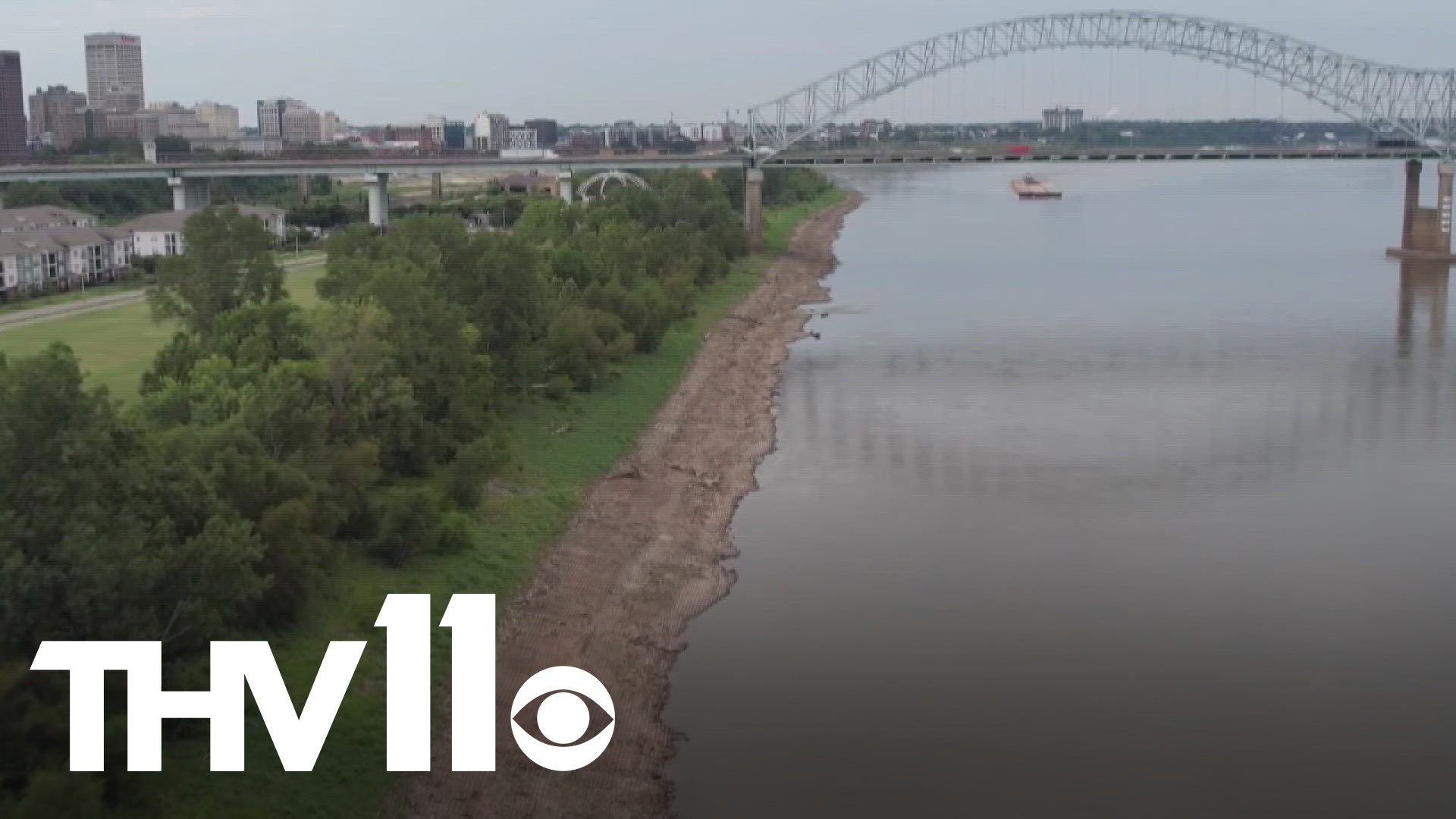

LITTLE ROCK, Ark. — The Mississippi River plays a significant role in transporting goods to and from Arkansas, and all eyes were on it last month when it reached record low levels for the second year in a row.

Experts kept a close eye on the river, hoping it would improve for farmers. Although things are looking up, there's a lot of uncertainty, which has Arkansas agriculture experts preparing.

"Things did get better for a while, especially right around that harvest time," University of Arkansas Assistant Professor of Agriculture Economics and Extension Economist Ryan Loy said. "We had a little bit more rain. However, the Mississippi River is still down."

Loy said that the water level is at -9 right now.

"It's four feet below what they consider low," Loy said.

While harvest might be over, impacts are still being felt.

"Producers who are still trying to market their grain are impacted negatively by that," Loy said. "The negative impact they feel right now is mainly around basis risk. The basis is cast minus future, so if it's more negative, that cash price is lower than the futures price."

Loy said this is leading producers to hold onto their grain longer.

"Hold on to it in the marketing; then they'll receive a higher price later if they're trying to go for cash prices," Loy said. "The mechanism behind that is simple supply and demand."

That one adjustment is a trend he said we could see continue.

"You will see a lot of these companies shifting to rail or truck. That's not what they want to do," Loy said. "For many reasons, the carbon footprint is more with a truck or rail. It's not as efficient as it can be with a barge."

Loy added there's still a lot of uncertainty regarding the river.

"This rain that we might get is great," Loy said. "We might be back to minimal levels, but at the same time, what happens when we roll around next year? Here we are again."

This is why he and other experts are finding ways that they can help Arkansas farmers continue to adjust.

"How can we better manage this risk and minimize the exposure," said Loy. "A lot of that comes back to forward contracting, hedging futures market, those sorts of things."