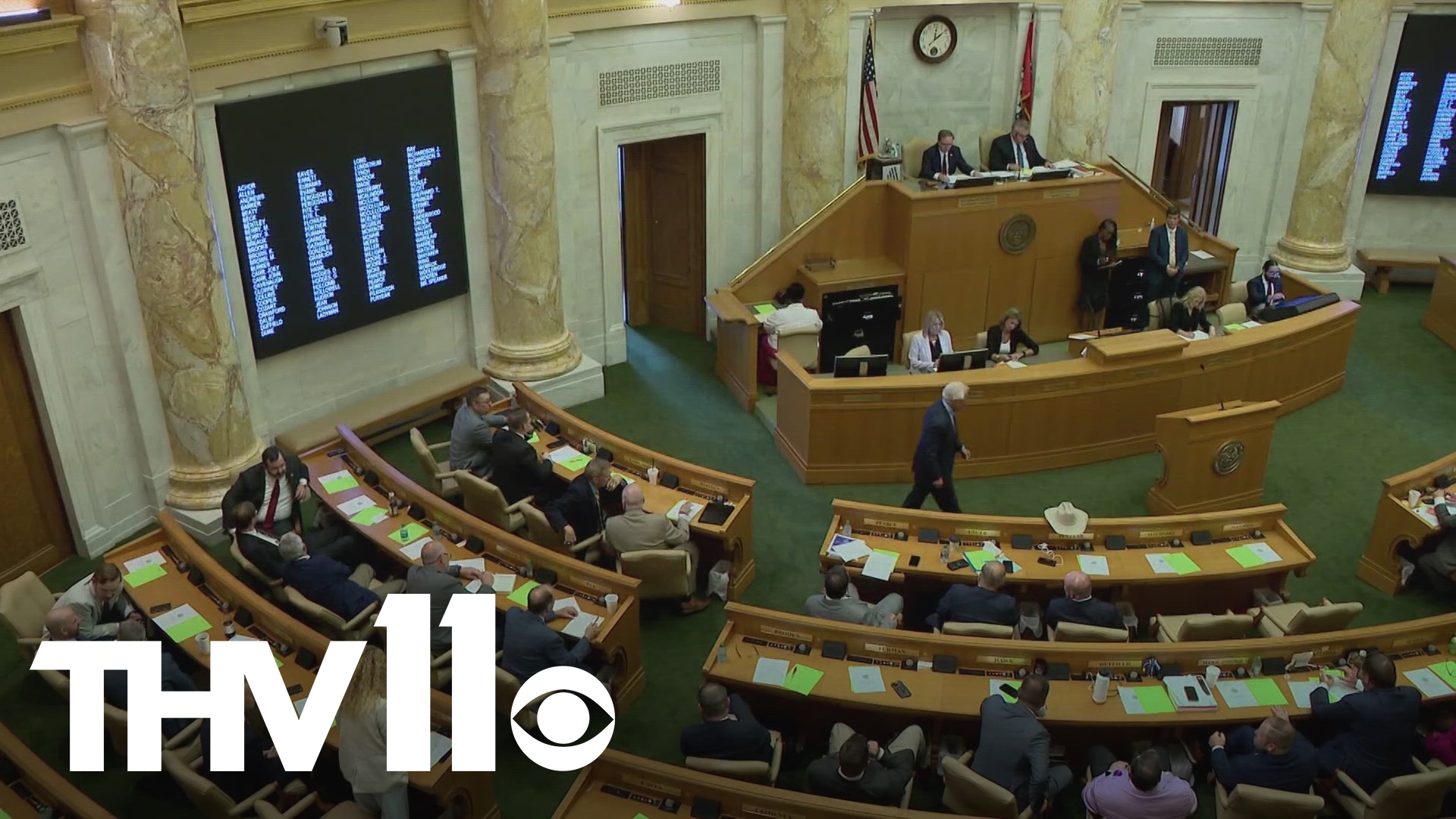

LITTLE ROCK, Ark. — Arkansas lawmakers on Monday advanced income and property tax cuts and a compromise proposal to avoid a shutdown of the state's hunting and fishing programs.

Lawmakers moved quickly on the main agenda items for the special session Republican Gov. Sarah Huckabee Sanders called last week. House and Senate committees endorsed identical versions of the tax cut measures, setting up initial floor votes in the predominantly Republican Legislature on Tuesday morning.

If approved, the income tax cuts would be third signed by Sanders, who has called for phasing out the income tax since she took office last year. The state has been forecast to end its current fiscal year with a $708 million surplus.

“I think we're in a good position to further reduce this tax burden on our citizens,” Republican Rep. Les Eaves said.

The legislation calls for cutting the top individual income tax rate from 4.4% to 3.9% and the top corporate rate from 4.8% to 4.3%, retroactive to Jan. 1. Finance officials say the cuts will cost about $483 million the first year and $322 million a year after that. The proposals are expected to easily pass both chambers, with most Republican lawmakers signed on as co-sponsors.

Democrats in the Legislature and advocacy groups have said they are worried the cuts are too skewed toward higher earners and have said the revenue could go toward other underfunded needs.

“Before cutting taxes again, we ask that you please invest in critical programs that help children thrive,” Keesa Smith, executive director of Arkansas Advocates for Children and Families, told a Senate panel.

State Representative Democrat Vivian Flowers emphasized that point in response to republican leaders citing issues with delays in government funding versus tax cuts.

"I don't think that it makes any sense for us to raise money as legislators running for office from the private sector, and then we get here, and then we talk about how government doesn't work. We are the government. And I think that if you know rules and regs don't work, we fix them," Flowers said.

The other bill advanced by the committees increases the homestead tax credit from $425 to $500, retroactive to Jan. 1. The cut, which will cost $46 million, will be paid from an existing property tax relief trust fund that consists of revenue from a 0.5% sales tax.

Lawmakers had expected to take up tax cuts later this year, but they accelerated their plans after the Legislature adjourned this year's session without a budget for the state Game and Fish Commission.

The appropriation for the commission, which issues hunting and fishing licenses and oversees conservation programs, stalled in the House last month over objections to the maximum pay for the agency's director. The vote created uncertainty about whether Game and Fish could operate when the fiscal year begins July 1.

A compromise measure advanced by the Joint Budget Committee on Monday sets the director's maximum salary at about $170,000 a year — $20,000 less than last month's proposal. But it would require legislative approval for any raise that exceeds 5%. The commission's director, Austin Booth, is currently paid about $152,000.

Booth said he was “absolutely fine” with the compromise, saying he wanted to ensure the agency would remain open and to increase trust with the Legislature.

“If this is the way to do it, then we couldn't be happier with it,” Booth told reporters.

Republican Sen. Jonathan Dismang, who co-chairs the budget panel, said he didn't want the bill to be viewed as a precedent for future disputes.

“I just don't want people to feel like we can't work out that compromise when we're supposed to be here in a regular or fiscal session,” Dismang said.