PINE BLUFF, Ark. — The current five-eighth cent sales tax in Pine Bluff was initially drafted in 2017 and it looked to improve education and economic development.

As a part of this year's tax campaign, the group is asking voters to cast a ballot to renew the sales tax.

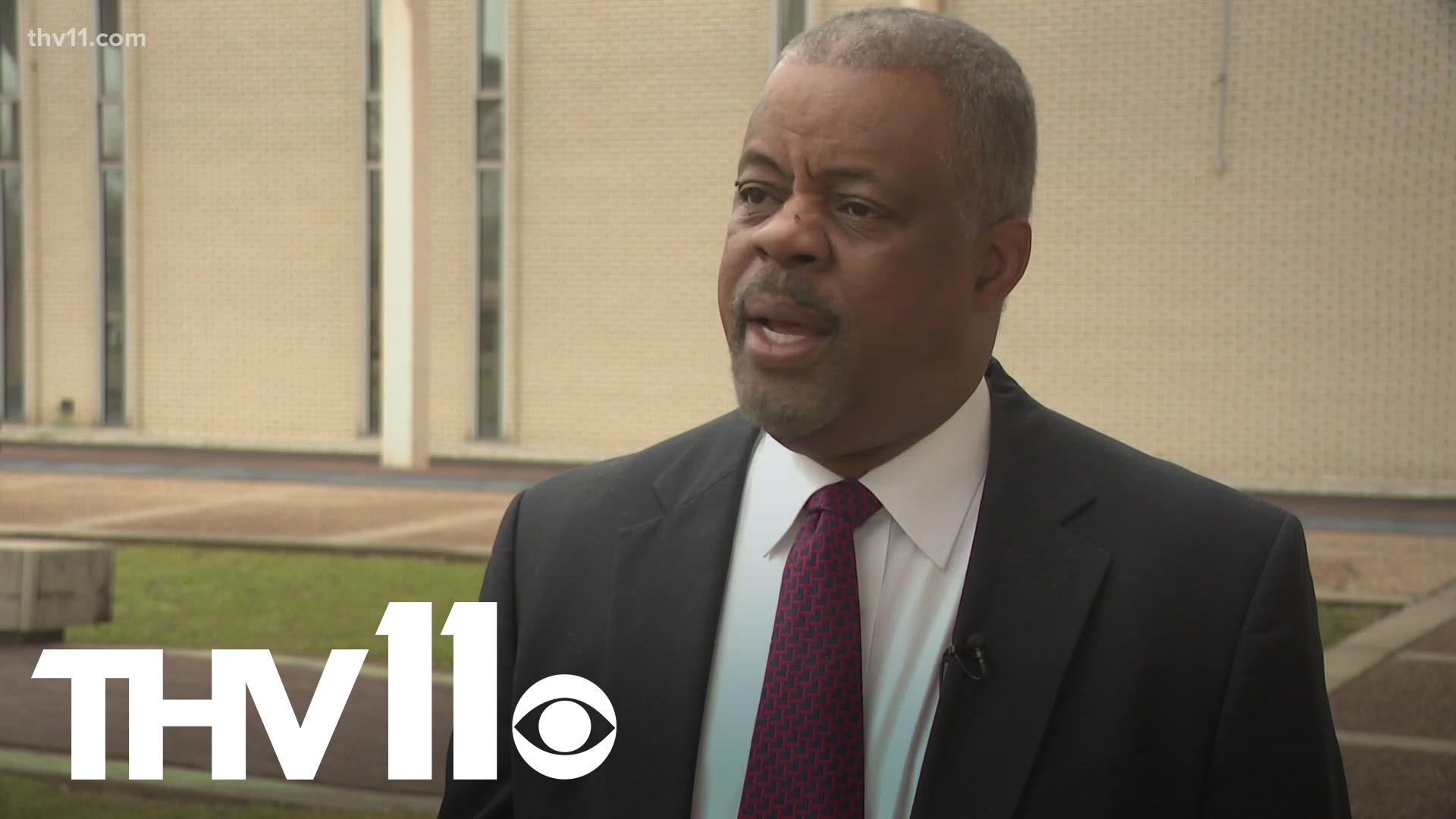

President of the Pine Bluff NAACP chapter Ivan Whitfield expressed his opposition to the renewal.

"We need tax dollars to stay in Pine Bluff," Whitfield said. "We need it to be invested in things that are going to really make an impact in our community."

The five-eighth cents sales tax would fund Go Forward's projects including advancing small businesses and revamping neighborhoods.

Three-eighth cents would fund public safety.

"This tax is a regressive tax on the poor," Whitfield said.

Go Forward Pine Bluff CEO Ryan Watley issued us this statement:

"Over the past five years, Go Forward Pine Bluff has worked in partnership with the City of Pine Bluff to reverse decades of decline concerning education, quality of life, economic development, and government infrastructure," Watley said. "This partnership has resulted in millions of dollars [public and private] to advance small business, improve the quality of instruction in schools, and rehabilitate neighborhoods amongst other accomplishments. Given that our community is 80% Black, 95% of our initiatives have advanced people of color. It is disappointing to learn of the NAACP’s stance. However, Go Forward Pine Bluff will continue to promote the difference made for all of Pine Bluff in hopes of gaining their support and passage of the ballot initiatives on May 9, 2023."

Whitfield wants accountability as Go Forward said about $30 million worth of its projects is nearly complete.

"There is no good result that they can produce with $30 million already," Whitfield said. "What are they going to do if it passes this time?"

He is also questioning the legality of their projects and is getting the state involved.

"They [Go Forward Pine Bluff] have not introduced it to the county here yet," Whitfield said. "Yes, we need some outside help [and] some eyes that can go further than we have [and] some attorneys that can look at the documents."

Whitfield said he feels the proposal is rushed.

The current sales tax plan expires in September 2024 and he believes this issue should be voted on during the 2024 gubernatorial election.