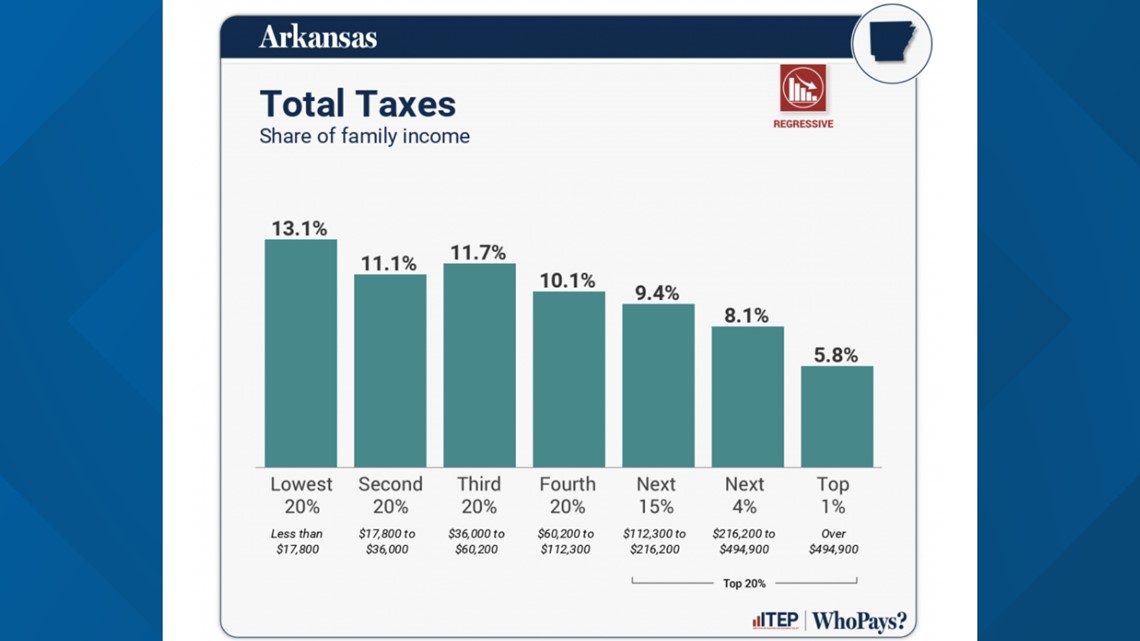

LITTLE ROCK, Ark. — An analysis of the tax systems of all 50 states in the United States found that Arkansas has the ninth most regressive tax system with the bottom 20% of income earners paying an average of three times more than wealthier individuals.

The report, which was released on Jan. 9 by the Institute on Taxation and Economic Policy, shows that most state and local tax systems have an "upside-down" structure where the wealthiest pay "a far lesser share of their income in taxes than low- and middle-income families."

Arkansas reportedly dropped six spots due to a "series of personal and corporate income tax cuts." Republican Gov. Sarah Huckabee Sanders signed two tax cuts into law in 2023. She has promised to eliminate the income tax in the state by phasing it out over time.

The first tax cut happened in April which cut the top bracket of individual income taxes from 4.9% to 4.7% and corporate income taxes from 5.3% to 5.1%.

Then in September, Sanders signed into law another tax cut that put the top individual income tax at 4.4% and the corporate income tax down to 4.8%. Under Arkansas law, income from $24,300 to $87,000 will be taxed 4.4% and anyone making more than $87,000 will also be taxed only 4.4%.

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that,” says Carl Davis, ITEP’s Research Director. “There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

While the top 1% pay only a 5.8% share of their income in taxes, the lowest 20% have to pay a 13.1% share of their income, according to the analysis.

Jim Hudson, Arkansas's Chief Financial Officer, responded to the analysis calling the state's income tax "progressive," noting that the "poorest Arkansans" pay no income tax at all. Anyone making less than $5,099 in the state does not have to pay taxes.

"Whatever regressivity may be present on the sales tax side, it's largely offset by the social services benefits on the expense side of the state budget," Hudson said in a thread on social media.

Hudson also claimed that "wealthier Arkansans tend to be" business owners or have "equity in public corporations" and thus "they pay derivatively pay income taxes within the corporate income tax structure as well."

ITEP, which has researched tax issues since 1980, examined all the tax laws that were in place as of Jan. 1, 2024. "In other words, the report shows the amount of income, consumption, and property taxes that would have been paid by residents in 2023 with the Jan. 1, 2024 law in place."

To read the full report on Arkansas's taxes, click here.